Existing contracts with service providers for services involving the disposal or destruction of consumer report information must comply with § 248.30(b) by July 1, 2006.įOR FURTHER INFORMATION CONTACT: For information regarding the rule amendments as they relate to investment companies or to investment advisers registered with the Commission, contact Penelope W.

The amendments also require the policies and procedures adopted under the safeguard rule to be in writing.Ĭompliance Date: July 1, 2005. Section 216 directs the Commission and other federal agencies to adopt regulations requiring that any person who maintains or possesses consumer report information or any compilation of consumer report information derived from a consumer report for a business purpose must properly dispose of the information. The amended rule implements the provision in section 216 of the Fair and Accurate Credit Transactions Act of 2003 requiring proper disposal of consumer report information and records. SUMMARY: The Securities and Exchange Commission (“Commission”) is adopting amendments to the rule under Regulation S-P requiring financial institutions to adopt policies and procedures to safeguard customer information. SECURITIES AND EXCHANGE COMMISSION 17 CFR Part 2-AJ24 Disposal of Consumer Report InformationĪGENCY: Securities and Exchange Commission.

For more information on FACTA, Red Flag Rules, and Identity Theft Consumer Information, please see the links provided below.Final Rule: Disposal of Consumer Report Information Release No.

#Fair and accurate credit transactions act code#

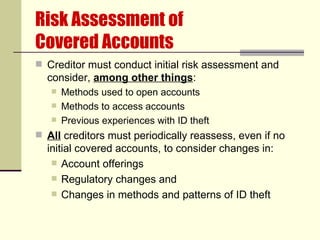

Action may include, but is not limited to, canceling of the transaction, notifying and cooperating with law enforcement, reporting to the Student Code of Conduct Office, and notifying the affected parties. If a transaction is deemed fraudulent, appropriate action will occur. In accordance with the Fair and Accurate Credit Transactions Act (FACTA) of 2003, Community College of Aurora adheres to the Federal Trade Commission's (FTC) Red Flag Rule (A Red Flag is any pattern, practice, or specific activity that indicates the possible existence of identity theft.), which implements Section 114 of the FACTA and to the Colorado Community College System's Identity Theft Prevention and Detection Program, which is intended to prevent, detect and mitigate identity theft in connection with establishing new covered accounts or an existing covered account held by the Colorado Community College System (System or CCCS) or one of its thirteen (13) community colleges, and to provide for continued administration of the Program.

0 kommentar(er)

0 kommentar(er)